Photo courtesy of Andrew Cooney

The June CoreLogic Hedonic Home Value Index results show Australian property values continue to trend lower in June amidst tight credit conditions and less investment activity.

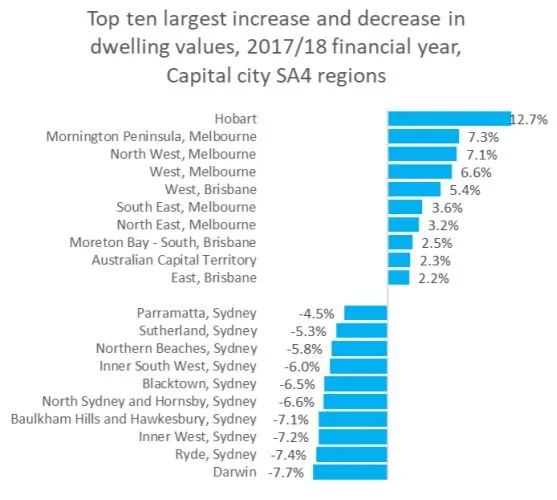

The largest falls over the financial year have largely been confined to Sydney. The Central Coast however, has been a top performer for NSW and is the only region to record a rise in dwelling values over the financial year, where values are up 1.6% over the past twelve months.

Lifestyle markets continue to show strong demand as well, with capital flowing into holiday home markets and areas popular with retiring baby boomers, which is partly why the Central Coast has out performed the Sydney market.

Central Coast property market is strong and growing

Whilst other markets have declined over the last 12 months, the Central Coast continues to draw a crowd from first home buyers, investors and the prestige market. Offering a wide variety of property types and budgets, the Central Coast region has continued to perform and attract buyers from other markets.

Terrigal beach - Photo courtesy of Andrew Cooney

Combined regional markets across the country have significantly outperformed the metro areas, showing a 7.3% return over the last 12 months.

Tight credit conditions affecting buyers

According to CoreLogic research director Tim Lawless, “Tighter finance conditions and less investment activity have been the primary drivers of weaker housing market conditions and we don’t see either of these factors relaxing over the second half of 2018, despite APRA’s 10 per cent investment speed limit being lifted this month.”

There are several reasons why home loan approvals are falling;

- Investment loan credit approvals tightening

- Lending criteria affected by the Royal Banking Commission

- Online lenders and comparison sites are riddled with inexperienced staff

- Borrower’s living expenses are under more scrutiny

- Housing demand is falling in capital cities

Securing a home loan for a Central Coast property

Whilst credit is tightening, this is partly to do with declining values in metro areas. As the Central Coast is performing well and property values experiencing growth, most property valuations are coming in at the purchase price. This is good news for borrowers, as the bank valuation is one of the biggest hurdles to jump when applying for a home loan.

Interest-only options have increased, and investment property interest rates are becoming more competitive. Borrowers looking to buy on the Central Coast now have more lender options, but it’s always important to work with a local Central Coast mortgage broker like Mint Equity to ensure you get the best home loan.

The new financial year brings changes to the way borrower’s credit data is shared, so it’s even more important to work with a mortgage broker to prepare for your home loan application at the early stages of your property search.

Preparation is key to home loan approval

If you’ve been out of the market for a while, the lending landscape has changed over the last few years. Years ago, if was a relatively quick and easy process to secure a home loan. Nowadays, every aspect of your credit history and borrowing capacity is scrutinised by the lenders.

Before you go house hunting, always speak to an experienced mortgage broker like Mint Equity so you know exactly how your application will be viewed by the lenders and how to prepare your finances for the best chance of a home loan approval.

References

CoreLogic Hedonic Home Value Index