If you’re a builder, tradie or supplier to the construction industry, now is the time to secure a good pipeline of work for 2019.

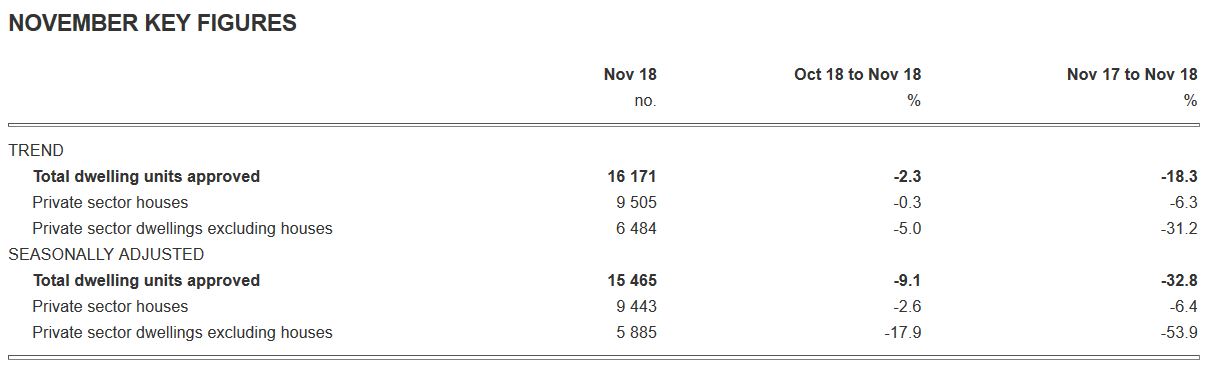

The latest ABS Building Approvals report released this week shows a sharp decline in construction approvals across Australia. Seasonally adjusted figures showed a decline of 32.8% over the last 12 months to November. Private sector dwellings excluding houses had a whopping 53.9% decline – which means the pipeline for multi-dwelling and unit construction is likely to dry up as developments reach completion.

"The trend for total dwellings has been steadily declining over the past twelve months," said Justin Lokhorst, Director of Construction Statistics at the ABS. "The series is now 18.3% lower than at the same time last year."

ANZ Research’s head of Australian economics David Plank said that he was “surprised” by the figures, claiming that the result would raise additional concern over the impact of the housing market slowdown on the broader economy.

“The weakness in the data will intensify concerns that a severe slowing in housing construction will hit the economy in 2019, even though the backlog of housing construction is high and the non-residential sector is robust,” Mr Plank said.

Whilst many of the other states showed a larger decline, NSW had a decline of 3.1% in November 2018 for total dwellings. The majority of these declines were in the multi-dwelling and unit approvals, whereas the number of private sector houses rose 0.1% in November 2018.

How will tradies be affected?

If you’re a tradie working on large scale developments, finding future work, particularly in Sydney, may prove difficult in the coming months. Back in May 2017, we saw a similar downturn in building approvals, so whilst building and construction is cyclical based on developers, we are now seeing several elements that could slow housing construction.

Whilst building approvals for the private sector housing is relatively stable, home builders need to be smarter with their suppliers in securing good pricing for products as home owners look to reduce their construction budgets. Read more about this below.

ABS Building Approvals November 2018

Tighter credit conditions affecting building approvals

Partly to blame for the decline housing approvals is the tightening of credit both to developers and home buyers. Banks have reduced their lending capability to large scale developers as Sydney has experienced an oversupply of units. Some locations around Sydney have postcode lending restrictions, meaning buyers have more difficulty in securing a home loan to purchase a unit in an area where there is an oversupply.

Property values have also dropped, adding to the difficult lending conditions. An uncertain housing market is producing less buyers, and properties are taking longer to sell – providing issues for developers to sell their stock. As a result, developers are also less interested in taking the risk on their next development for fear they won’t sell.

Renovations and new builds budgets decline as housing values drop

Whilst some home owners are looking to renovate or extend rather than buying a new property, the money they are spending on the build is dropping. As property values drop, availably equity also drops. A year ago, a home owner might be able to access $500,000 of equity in their property, but as the property value declines, they may now only be able to access $400,000. That value drop can have a significant impact on the construction budget they have and also increase the risk of over-capitalising on the property.

Loans for renovations

Whilst property values are dropping, particularly in Sydney, renovating and extending is still a popular option for home owners. Construction loans are still accessible, given there is sufficient equity in the property. The key is working with an experienced Sydney mortgage broker like Mint Equity who knows which property valuers are providing the most favourable valuation.