What exactly does a mortgage broker do?

A mortgage broker is a person who holds a qualification of either a Certificate IV in Finance and Mortgage Broking (FNS40815) or a Diploma of Finance and Mortgage Broking Management (FNS50315), and is registered and authorised with ASIC as a credit representative. Their qualification and registration as a credit representative enables them to become accredited with banks and credit unions (lenders) to arrange finance for the consumer.

You can search the ASIC professional register to check that your credit representative is authorised, what license they hold and if they are still current. This is also useful to see how long they have been an authorised credit representative, a indicator of their tenure as a mortgage broker.

In order to be accredited with a lender, the mortgage broker must meet industry experience and qualification standards and pass a test to indicate they understand the products and credit policy of that lender.

The more lenders the broker is accredited with, the more finance options they can provide to consumers.

When a consumer seeks the assistance of a mortgage broker, the broker must review the consumer’s finance requirements, borrowing capacity, ability to pay back the finance, the consumer’s credit history and living expenses (there’s more but we’ll keep it basic for these purposes). The broker will then provide options and guidance to the consumer to meet their needs and ensure they are suitable for the purpose.

“Approximately 54% of new residential home loans are now written through brokers, compared to only about a quarter in 2003 (MFAA 2017; RBA 2004). Some lenders believe that the share of home loans written through brokers will ultimately increase to 60% (EY 2015).”

Once the consumer selects the most suitable loan and lender, the mortgage broker prepares the loan application, liaises with the lender to check the latest credit policies, negotiate a discounted interest rate, co-ordinates with the client’s solicitor (and accountant if need be), reviews supporting documentation, and submits the application to the lender. The broker then liaises with the lender to arrange a timely approval to meet the settlement deadline. The mortgage broker will assist the client with the mortgage document sign up and ensure all data is correct and there are no issues that will delay settlement.

After settlement, the mortgage broker will use their relationship with the lender to continue to service the client and is the first point of contact if there are any issues throughout the life of the loan. They also conduct regular pricing reviews to ensure the client continues to get the best available interest rate, liaise with the lender regarding discounts, increases and changes in loan structure amongst other things.

Do mortgage brokers work for the bank?

No, mortgage brokers are independent from the banks and lenders they are accredited with. Mortgage brokers work for the consumer, and in most cases, receive a payment from the lender the consumer chooses. Mortgage brokers must always disclose an estimate of how much they will be paid to the consumer. This is provided to the consumer in the form of a ‘Credit Proposal Disclosure’ document and a ‘Credit Guide’. Most mortgage brokers don’t charge the consumer for their services, as they receive a payment from the lender if the loan settles. If the mortgage broker provides the consumer with the assistance, but the consumer doesn’t settle the loan, the mortgage broker does not receive any payment from the lender.

Is a lending specialist, credit adviser, sales associate, finance broker the same as a mortgage broker?

Each finance company can choose to title their employees or contractors to reflect the role they play. Traditionally the mortgage/finance industry uses ‘Finance Broker’ or ‘Mortgage Broker’ as the position title for the role of a credit representative. However, some companies use other titles to reflect the experience and seniority of the credit representative within the organisation.

With the introduction of online lending models, often the person the consumer liaises with can be a support person rather than an actual credit representative. Some mortgage brokerages and online lending platforms refer to a ‘Home Loan Specialist’ whereby a less experienced person liaises with the consumer throughout the process, then an authorised credit representative will sign off on the application, potentially never meeting or speaking directly with the consumer.

If you are unsure if the mortgage broker or ‘Home Loan Specialist’ is qualified, you can search their last name under the ‘credit representative’ category on ASIC’s professional register to see if they are registered.

“In 2017, there were approximately 16,000 mortgage brokers in Australia.”

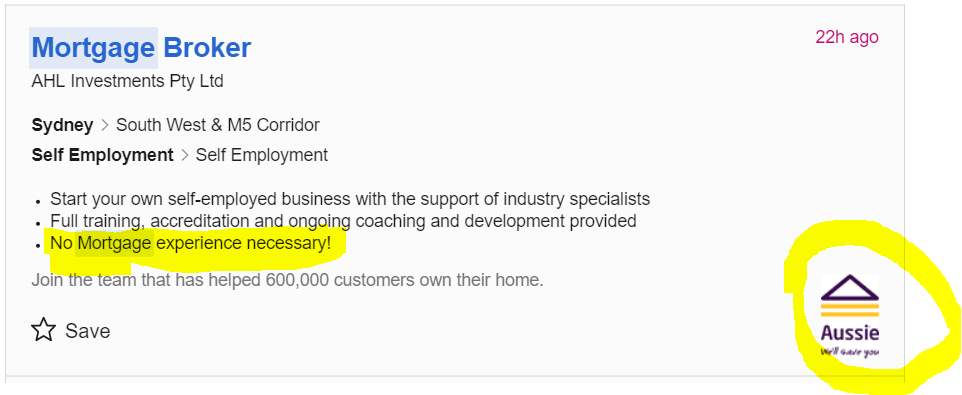

Not all mortgage brokers are created equal. Unfortunately, even big name players like Aussie Home Loans advertise that ‘no mortgage experience is necessary’ to become an Aussie mortgage broker. This should be a major concern for the industry and even CBA (ironically, CBA owns Aussie) have identified that industry experience is crucial to providing consumers with the right outcomes. CBA have changed their accreditation process and will not allow any mortgage brokers with less than 2 years experience to become accredited.

Not all mortgage brokers are created equal. Unfortunately, even big name players like Aussie Home Loans advertise that ‘no mortgage experience is necessary’ to become an Aussie mortgage broker. Image from Seek.com.au

Our story: Lending experience

We think the changes CBA have made to the accreditation process is the start of improving the capability and expertise in the industry. We believe other lenders will also follow this practice and consumers will benefit from an improvement of experience within the industry.

Whilst the majority of the industry is experienced and ethical, we worry that some consumers are receiving ‘expertise’ from inexperienced mortgage brokers. To apply real life knowledge and industry expertise to consumers, we believe a mortgage broker must have worked in the lending sector for at least 5 years. Given the high quality of our services and client needs, Mint Equity does not employ any ‘new to industry’ mortgage brokers to service our clientele.

“Mortgage brokers can benefit consumers by being more effective at selecting the best loan and negotiating with lenders because they are more familiar with the home loan market. This can also increase competition among home loan

providers. ”

How do I know who owns a mortgage broker?

Over the years some banks and lenders have invested in the ownership of some mortgage broker companies and aggregators (aggregators provide the credit license for some mortgage brokers). For example, Aussie Home Loans is 100% owned by CBA, and Macquarie Bank Limited has a minority interest in Lendi (online lender), yet the mortgage brokers offer mortgage products from other banks and lenders, in addition to CBA and Macquarie Bank products

Part of the Royal Banking Commission’s and Productivity Commission quest is to increase the disclosure of ownership to ensure there is no implied conflict of interest. If you are unsure of who owns the mortgage broker you are dealing with, you should ask them and also review their Credit Guide which should disclose any ownership.

Our story: Who owns Mint Equity?

Mint Equity has two directors, Zac Peteh and Leigh Peteh, with equal shareholding.

Mint Equity directors, Zac and Leigh Peteh

Mint Equity has approval to utilise credit providers and loan products through the services of our aggregator ‘Connective Broker Services Pty Ltd ABN 77 161 731 111, Credit Representative 437202 authorised under Australian Credit Licence 389328’. The aggregator charges Mint Equity a membership fee and a monthly fee for each of our accredited loan writers.

Macquarie Bank Limited has a minority, non-controlling interest in Connective Broker Services Pty Ltd. Commissions paid by Connective’s lender panel are transparent and do not influence the broker or consumer choice. Connective is committed to quality consumer outcomes in all circumstances.

This content is a direct copy of a section of our Credit Guide which we provide to our clients when they engage our services.

In addition, Mint Equity does not hold any partnerships with other finance, property or related services, ensuring we don’t have conflicts of interest – a critical component for our clients who expect a high standard of service without compromise.

Why is the finance industry under scrutiny?

Prime Minister, Malcolm Turnbull, called for a Royal Banking Commission, costing tax payers an estimated $100m, after pressure mounted by Labour leader Bill Shorten. The commission commenced earlier this year and covers banking, wealth management, superannuation and insurance industries.

From the onset, fingers were pointed, the blame game was played, and misrepresentations have been made. For some of those executives interviewed by the commission, diverting attention from the banks towards the broker segment is a safer career move. But when over 50% of all home loans in Australia are arranged by Mortgage Brokers, consumers need information beyond the headlines.

Further information

This article is part of a Q&A series to assist consumers with making informed choices regarding the way they secure their finance and to address issues raised in the Royal Banking Commission and Productivity Commission. If you need further information, have feedback, or have a specific question you want answered, please contact us.

References

Productivity Commission Draft Report