From January 2023, First Home Buyers in NSW will get to choose if they want to pay a lump sum stamp duty tax or a smaller annual property tax, on their property purchase up to $1.5 million.

Whilst it’s hard to believe there would be that many first home buyers looking to purchase in that price bracket, many first home buyers are essentially, getting older. Only 61% of first home buyers are under the age of 35 which means the remaining group have been in the workforce for longer and have income that supports purchases up to $1.5 million.

Currently there are stamp duty exemptions and concessions for purchases up to $800,000, but many first home buyers don’t qualify for those discounts because the property purchase price is more than $800,000.

The NSW Government is looking to target those first home buyers with the option of paying an annual property tax rather than a stamp duty lump sum – which must be paid for from their savings (ie, you can’t borrow to pay the stamp duty).

NSW Government property tax plan

This isn’t a new idea from the NSW Government, they previously flagged this change in August 2021, however their original plan meant that the selection of either stamp duty or annual property tax was tied to the property forever. That would mean if a buyer selected the annual property tax when they purchased it, every buyer following that would also have to pay the annual property tax, rather than choosing to pay a lump sum stamp duty. This is very important when it comes to buying an investment property, as we’ll discuss more below.

Property tax plan will increase rents

For any first home buyers looking to purchase a property for investment purposes utilising the property tax option, will be slugged a higher rate.

The property tax rates for 2022-23 will be:

Owner Occupied

$400 plus 0.3% of land value

Investment

$1,500 plus 1.1% of land value

The NSW Government has provided the following example to demonstrate how this could work.

"Ranit is buying his first home, a $1.2 million townhouse in Newcastle. The land value of this property is $720,000.

"Stamp duty on this purchase is $50,875, and the purchase price is above the threshold for any first home buyer stamp duty concessions.

"In 2022-23, property tax on the property would be $2,560.

"Ranit is not sure how long he will own the property, but he has heard that half of all owner-occupiers sell their property within about ten years.

"Not having to pay stamp duty would really help to lower the up-front costs of the purchase, so Ranit chooses the property tax."

But in reality, let’s look at the situation if Ranit paid property tax for the next 10 years, assuming a conservative land value increase of 7% every year after an initial decrease given the current property market.

The table below shows that Ranit would indeed save just over $20,000 if he held the property for 10 years as an owner occupied property, however if Ranit decided to rent out the property, the annual property tax would increase significantly.

It’s also safe to assume that the proposed rate of 0.3% and 1.1% for property tax calculations won’t stay at that level forever and may well be indexed to inflation or CPI. However, for this example, we’ve kept the property tax rates at the original level.

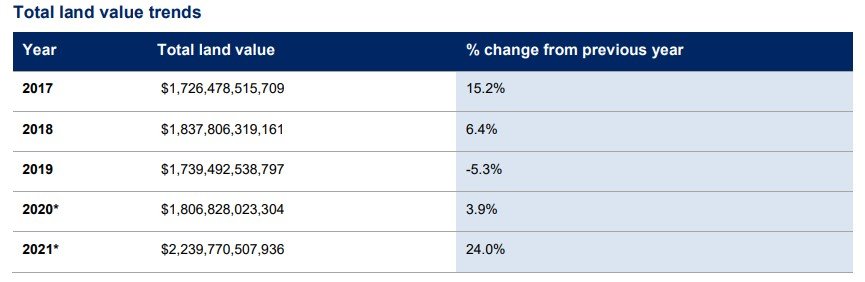

* Note, the percentage increase of land values from 2020 to 2021 in the Newcastle region was 38.1%

Land values in NSW have increased by 12.5% on average over the last 5 years.

Assumptions are made to a small decline in land values (assuming the Valuer General revalue properties in a declining market year), and a conservative increase of 7% for the following 7 years.

Investors and renters will pay the price of stamp duty removal

As you can see from the calculations, first home buyers who chose the property tax option for the purchase of an investment property will pay almost $60,000 more over the 10 years of ownership. Even at the lowest level of $9,420 for year 1, that equates to $181 per week, growing to $269 per week in 2031.

It’s unlikely that an investor would absorb these increased running costs and they will be passed onto renters, making renting even more unaffordable.

If the NSW Government ties the annual property tax choice to the property in perpetuity, we would see many properties drop in value because of the expensive investor property tax attached to them. Why would anyone want to buy an investment property that has property tax on it? Particularly a property that already has other running costs like strata or body corporate rates. Unfortunately, the NSW Government haven’t thought this through when it comes to affordable housing and long-term effects of this tax.