We all love it when the government announces tax cuts or removal but it’s only when we dig a little deeper do we see who the winners and losers are of the proposed property tax changes.

Property Tax proposal to replace NSW Stamp Duty

Stamp Duty is a tax payable on all property purchases which has to be paid within 30 days of settlement. Currently it is an upfront cost which varies depending on whether the property will be your primary residence or investment property and if you are a first home buyer or foreign purchaser. The amounts also vary from state to state.

Property stamp duty has long been one of those taxes that is outdated and a financial barrier to home ownership and many experts and politicians have been calling for a review.

Yesterday, the NSW Government announced proposed changes to replace stamp duty with a new property tax based on the land value. The government has promoted the changes as giving you the “freedom to choose between paying stamp duty upfront or paying a much smaller annual property tax.”

But, here’s the catch…

If you choose the ‘annual property tax’, it’s stays with the property forever and will increase as land values increase.

Essentially, only the first person to buy that property will have the choice. If that buyer selects the ‘annual property tax’, the next buyer will continue to pay the annual tax for as long as they own the property.

Fast forward 25 years, and it’s likely we’ll see most properties have property tax applied to them.

Short term savings for long term cash flow demands

Sure, there are some benefits to a smaller annual payment rather than a high upfront tax, but it’s the ongoing costs to the home owner and investors that are of concern.

If only we all had a crystal ball when it came to buying property, but the reality is most people don’t know how long they will live in a property or hold onto an investment property, so it can be difficult to work out which option is best.

According to sales data by CoreLogic, property owners are on average holding on to a house for 11.3 years and units for 9.6 years. This duration has increased over the past 10 years, so people are holding on to properties for longer than they used to. This could be a reflection of the rising cost of selling and purchasing property.

So, for those with the plan to hold the property long term, an annual property tax will continue to be a drain on the owners cashflow well into the future.

If you choose the ‘annual property tax’, it’s stays with the property forever and will increase as land values increase.

Essentially, only the first person to buy that property will have the choice. If that buyer selects the ‘annual property tax’, the next buyer will continue to pay the annual tax for as long as they own the property.

Fast forward 25 years, and it’s likely we’ll see most properties have property tax applied to them.

How are land values calculated?

The NSW Government Valuer General oversees the valuation system, where 2.6 million parcels of land are valued each year as at 1 July. The valuation is based only on the land, and doesn’t include the value of your home or other structures or improvements. Valuers use a mass valuation process to value most of the land in NSW by grouping similar properties that are expected to experience similar changes in value.

You can find your land value on your Notice of Valuation from the Valuer General or land tax assessment from Revenue NSW. You can also search your land value online

To find your property number, use the NSW Valuer General Property Address Enquiry tool

To find your current land value, use the NSW Valuer General Land Value Search tool

How much will I pay in property tax?

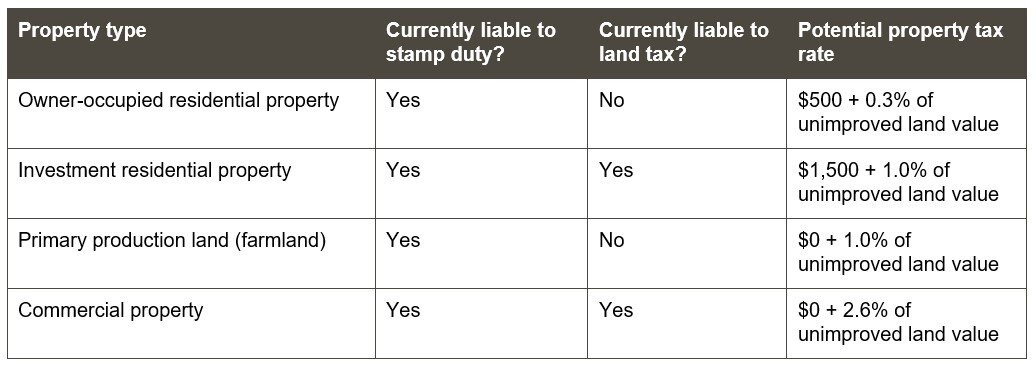

The NSW Government is proposing a tax rate dependant on the property type, calculated on the land value, not the purchase price.

The potential property tax rate varies significantly between owner-occupied residential property and investment property. Investors who hold properties would be have a much shorter break even point than owner occupied purchasers. The following scenarios are based on purchasing a property with a land value of $800,000 and a purchase price of $1,700,000.

Owner Occupied residential properties $500 + 0.3% of unimproved land value per year

For example, if you purchase an owner occupied residential property with a land value of $800,000 you’ll pay $500 plus 0.3% of the land value every year. That’s $500 + $2400 = $2,900 pa.

Now assuming the property was originally purchased for $1,700,000, the upfront stamp duty would have been $78,798.

In this scenario, you would need to hold the property for 27 years to pay the equivalent property tax as you would have paid stamp duty.

Investment residential properties $1,500 + 1.0% of unimproved land value per year

Now if the property was purchased as an investment property, the property tax rate changes to $1,500 plus 1% of the land value. That’s $1500 + $8,000 = $9,500 pa.

Under current arrangements, the stamp duty for investment properties is the same as owner occupied, being $78,798. You would need to hold the property for 8 years to pay the equivalent property tax as you would have paid stamp duty.

This equates to $182 per week, which needs to be considered in terms of rental yield.

Commercial properties $0 + 2.6% of unimproved land value per year

If you were to buy a commercial property, the property tax rate changes to $0 + $2.6% of the land value. That’s $0 + $20,800 pa.

Currently the transfer of land/business tax for a purchase price of $1,700,000 is $78,505. You would need to hold the property for 3 years before you would have paid the equivalent property tax as you would have paid in transfer duty.

This equates to $400 per week, which needs to be considered in terms of rental yield for the commercial property.

Winners and losers of NSW Government Property Tax proposal

Owner occupied property purchasers = Winner

Developers and renovators/flippers = Winner

Short term investment property purchasers = Winner

Long term investment property purchasers = Loser

Commercial property purchasers = Loser

Renters = Loser

As you can see the implementation of a property tax vs stamp duty is heavily swayed towards the owner occupied purchases, with investors paying the most in property tax if they plan to hold the property long term. Property developers and flippers will benefit from an annual property tax, but the following purchaser will be responsible for the future of that property’s tax.

As there will be an increase on annual costs associated with investment properties under a property tax scenario, renters may find that rents increase as a result of investors looking to recover their ongoing property costs.

It is also dependant on how accurate the land value is, particularly now they are proposing to calculate fees based on them. As Sydney mortgage brokers, we’ve noticed over the last two years, land values have been reviewed more accurately in conjunction with rising property prices. If this proposal does go ahead, don’t be surprised if you find your land value increases as of 1 July 2021.

Consultation process now open

You can have your say on the proposed tax reforms by visiting Have Your Say NSW Property Tax Proposal

Looking to buy now?

Even with stamp duty or with proposed plans to move to a property tax, property is still the most popular asset class in Australia. Interest rates are at record lows and they are expected to remain low for the next 4 years. If you’re considering buying or refinancing, contact the team at Mint Equity on 02 4340 4847.