Contrary to the mainstream media narrative, the property crash just doesn’t appear to be happening. Overall Australian capital dwelling prices decreased -1.4% last month but are 4.6% higher over the last 12 months. Houses are selling better than apartments, but a shortage of good properties on the market is seeing A-grade properties selling quickly with minimal discounting.

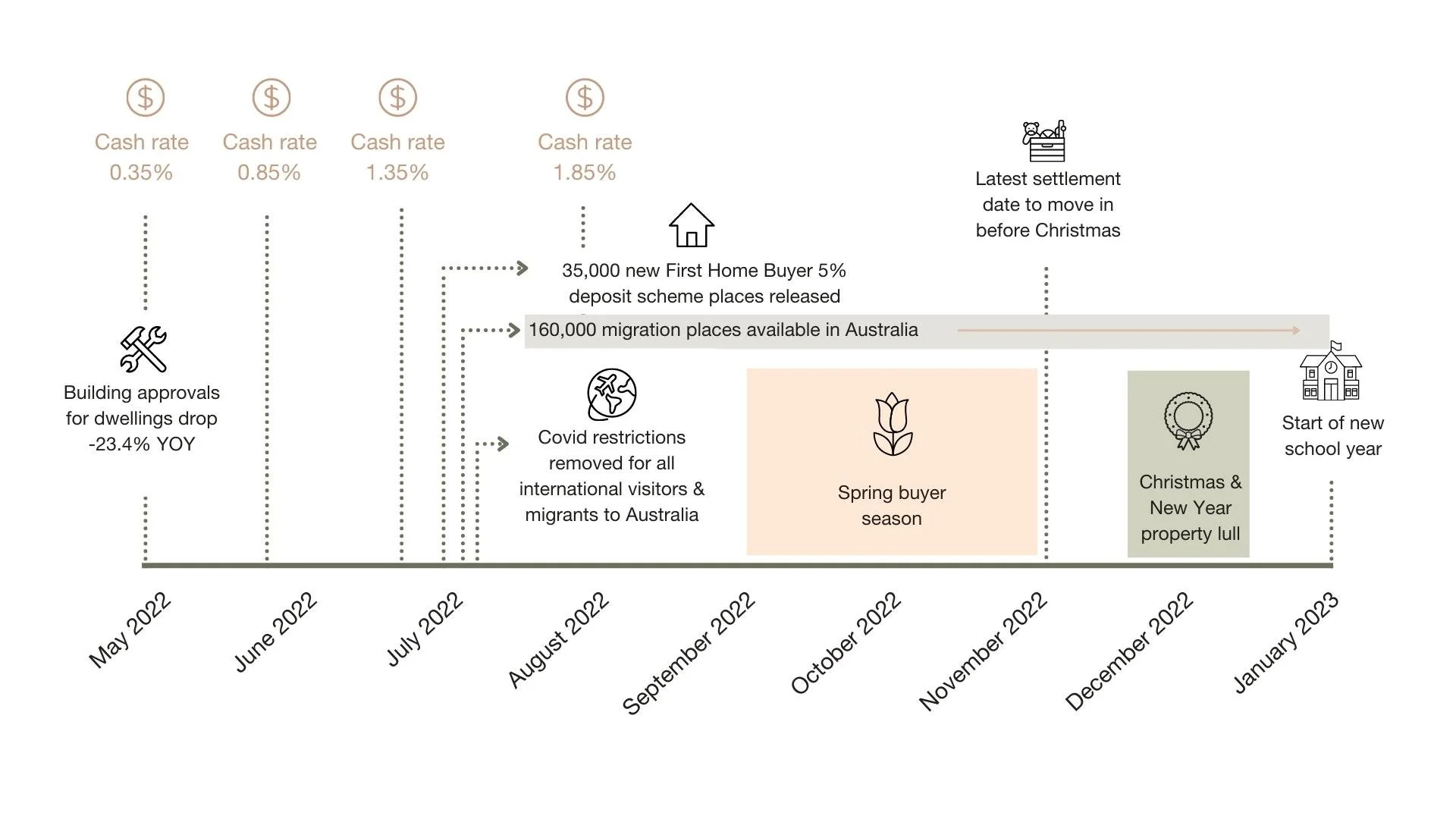

The recent RBA cash rate increases definitely made some buyers hesitate, however we’re now seeing an increase in home loan pre-approval applications, which means buyers are getting ready to re-enter the market.

Spring buying season has kicked off early and with more quality listings hitting the market now, buyers have a window of opportunity to secure a new home or investment property before the competition heats up. So, if you’re thinking about buying a home or investment property, you might want to do so sooner rather than later.

Fixed interest rates

12 months ago was the perfect time to fix your interest rate. Congratulations to many of our clients who secured 2 and 3 year fixed rates of 1.89% and 1.99% last year - you played the banks perfectly!

Today fixed rates are…

1 year fixed rates range between 4.49% and 9.19%*

2 year fixed rates range between 4.99% and 9.29%*

3 year fixed rates range between 4.99% and 8.60%*

4 year fixed rates range between 4.99% and 8.60%*

5 year fixed rates range between 4.99% and 8.60%*

*Depending on the lender and product selected. Rates are based on 80% LVR with a loan amount of $800,000 and updated 23 September 2022.

So, unless you have very specific reasons for needing to fix your home loan interest rate now, you might want to consider variable rates.

Variable interest rates

Variable home loan interest rates are still competitive at around 3.34% for online lenders and the likes of Suncorp, BoQ, Bankwest, Citibank, Newcastle Permanent and Macquarie range between 4.09% and 4.26%.

The majors (CBA, NAB, ANZ, St George and Westpac) variable interest rates range between 4.19% and 7.29%, so looking outside the majors for variable interest rates would be your best bet.

These interest rates are their advertised rates, and we always seek a discount from the lender, but you can see how they vary considerably. The key is to secure a lower starting point to help ride out the impact of future interest rate increases.

Cash back offers

Banks are at it again and they want your business. We have one lender offering up to $6,000 cash back where the home loan amount is $1M or more for new purchase and refinance applications submitted by 31 August 2022 and settled by 30 November 2022. Whilst they don’t have the cheapest interest rates in the market, the cashback offer might help cover future potential interest rate increases.

Will interest rates continue to rise?

Some industry experts are predicting that the cash rate is likely to peak at the end of 2022, remain stable throughout 2023 and then reduce in 2024 as inflation gets under control. So, the question is, if you can hold out on a variable interest rate between now and then, you may come out in front, given there is currently a 1.89% difference between fixed and variable rates, which would equate to 7 x rate increases of 0.25% or 3 x rate increases of 0.50%. However, if you are comfortable paying more now and don’t want the stress of hearing about ‘another rate rise’, a fixed rate may suit your needs better.