According to the latest data from CBA’s Household Spending Intentions report released on 12 July 2022, the cash rate increases by the RBA haven’t scared everyone out of the market. The home buying index declined slightly by -3.6% in June. This minor downturn isn’t unsurprising, but it by no means is as dramatic as the media is portraying.

The media are desperate for stories at the moment, even The Australian newspaper wrote an article about the ‘property market distress eruption’ which included an image of a volcano spurting out lava. No wonder some property buyers are spooked with headlines and graphics like that.

The interesting thing is that’s not what we’re seeing. As mortgage brokers, we are on the front lines and often see trends before they are even reported by media who gaslight the property market by citing a rupture of planetary-mass levels.

Sure, some of the first home and investment property buyers are delaying their purchases for a few months to “see if property prices will drop”, but it’s the experienced property buyers who are active in the market. Our expectation that any drop in prices will be very short lived.

Low supply leads to higher prices

Supply is a key driver for property values and those monitoring the market will consider the factors that will lead to a housing shortage in FY23 Q3 and Q4 and into FY24;

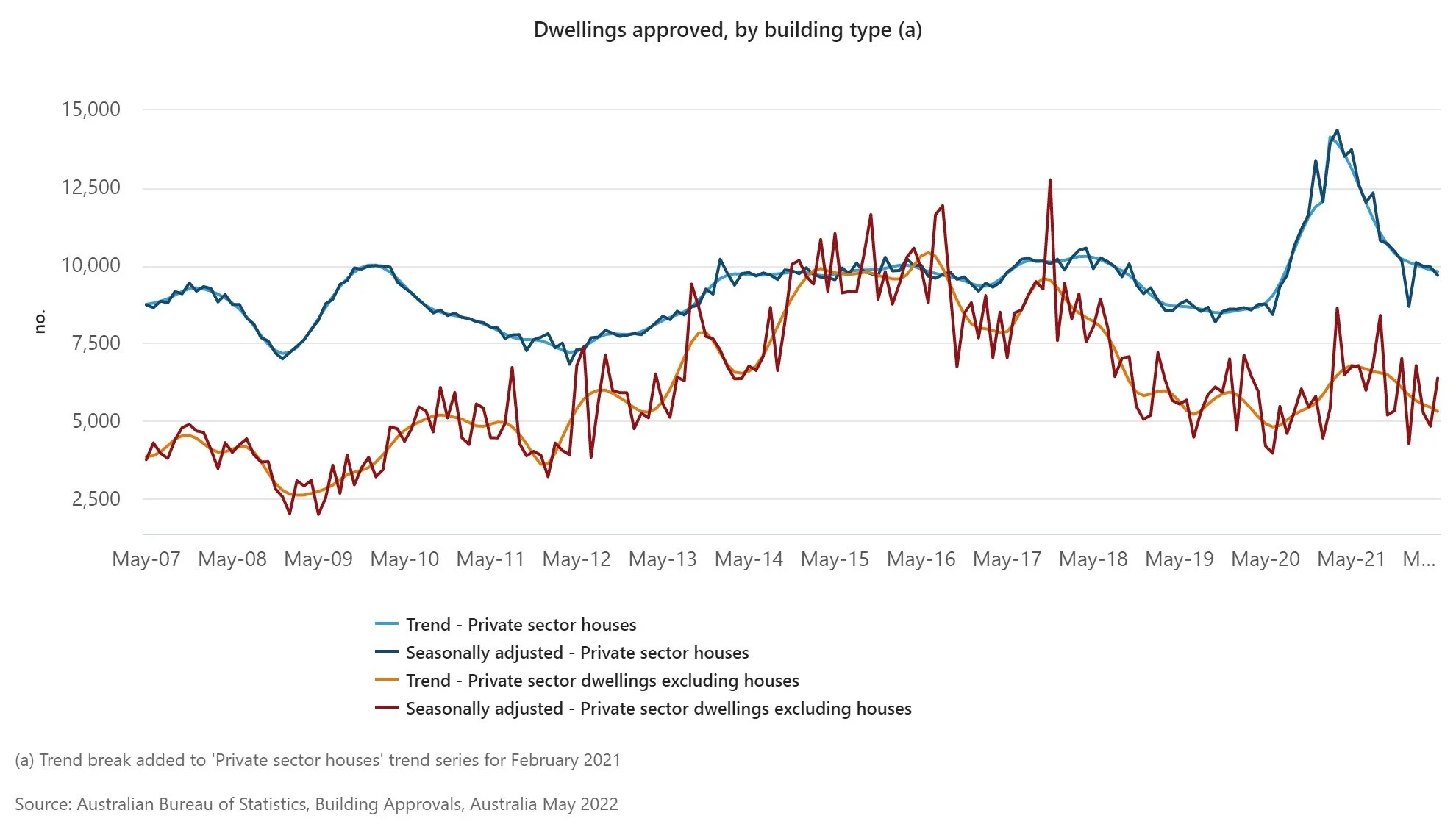

Building approvals have dropped by -23.4% YOY as of May 2022 and have been dropping since March 2021 with new housing availability expected to stagnate in 12-24 months

Covid restrictions removed for all international visitors and migrants to Australia from July 2022 which means we will see an uplift in immigration and returning Australian’s who all need housing

160,000 migration places available in Australia from July 2022, who will all need rental accommodation

35,000 new First Home Buyer Deposit Scheme places released in July 2022 creating more demand in the sub $1M price brackets

Spring buyer season starts on 1 September and traditionally buyers want to settle before Christmas, creating a demand for properties in the spring season

Rental vacancy rates are at the lowest level ever and demand for permanent rentals has even driven the Queensland Government to encourage investors to convert their AirBnB properties to permanent rental or face a short term letting tax.

Experienced buyers and investors, particularly the ones who have seen interest rates much higher than they are now, know that interest rates were never going to stay at record low levels. These buyers have seen variable interest rates at over 5% previously, so when variable interest rates increase from 1.99% to 3% or 4%, they realise even with several cash rate increases, home loan interest rates are still low.

Winter buyers have the upper hand

Many buyers don’t realise the property market is seasonal. Traditionally winter is a good time to buy and a bad time to sell. That is because there are always fewer buyers out and about in winter. It’s cold, it’s in the middle of the year which is painful for families changing schools after they move to a new property.

Winter buyers will face far less competition and that’s what we are seeing at the moment. Sellers don’t like to sell in winter because they can’t show their property to their full potential. Rain and low temperatures can expose issues with properties, ie, rising damp, drainage issues and poor insulation, so sellers prefer to wait until Spring arrives and the weather is more ideal.

Buyers who are active in the winter are able to negotiate better pricing as only those who need to sell in winter do. The key to buying at a good price is hugely dependent on the competition levels. There are fewer buyers in winter, so buyers are more likely to pick up a bargain. According to a study by Peter Rossini, a property expert from the University of South Australia, properties sell for approximately 1% less in winter than in other seasons.

Don’t take our word for it, Smart Property Investment agrees winter is a good time to buy property.

Spring buying season more popular and competition will be higher

Spring officially starts 1 September, and it is the biggest property season in Australia. Flowers bloom, birds are chirping, and the weather is at a comfortable level for inspections. Spring is the best time to sell as there are more buyers in the market. It’s perfect timing for families looking to relocate, purchase and settle before Christmas. This gives families the ability to start new schooling at the beginning of the year.

There is always a delay on properties coming onto the market after a slow selling season and this year it’s likely that there will be fewer properties hitting the market in September due to media reports about property prices dropping. That means those buyers who are looking to purchase in September will find fewer properties on the market and an increase in demand from other buyers, which effectively will keep prices stable (at the very least).

Building approvals at record low – supply demand issue will lead to increased property prices

Building approvals have been dropping since March 2021. Not only are we seeing construction companies close their doors, the volume of individuals and developers applying to build more dwellings is falling as low as back in May 2012.

The issue with a reduction in new housing is that the demand for housing in Australia is strong. We have overseas migration finally starting to return due and renters are screaming out for more affordable housing. When the demand for housing isn’t met with supply, we see the value of properties increase.