Should I fix my home loan interest rate or take the risk with variable?

It’s a question many mortgage holders are facing at the moment as they look to purchase or refinance their home loan. For the last 2 years, the difference between fixed and variable interest rates haven’t been substantially different, in fact, fixed interest rates have been incredibly low. Until now.

In the last 2 months, fixed interest rates have skyrocketed. The question is, why? Are the banks providing a safety net for mortgage holders or are they profiteering from the fear of interest rate rises?

To help mortgage holders make the best decision for their situation, they need to consider four things;

the cash rate

bank assessment rates

advertised variable interest rates, and

fixed interest rates.

The cash rate

The cash rate set by the Reserve Bank of Australia has been at 0.10% since November 2020.

The cash rate before governments started locking down their countries to avoid spreading Covid (December 2019) was at 0.75%.

A year earlier in December 2018, the cash rate was 1.50%

Why is this relevant?

Because we all need to remember that we currently have the lowest cash rate ever. Perspective needs to be kept in check when the water cooler conversations are about how many people are going to default on their mortgages when the cash rate and interest rates increase. Fear and panic isn’t valid, and we’ll explain why.

Bank assessment rates

Do you know what bank assessment rates are, and how they influence your borrowing capacity?

To those who aren’t in the industry or haven’t recently gone through a home loan approval, bank assessment rates are the interest rate the bank uses to assess how much you can borrow – in a stressed situation.

That means, when the bank calculates your borrowing capacity, they take the interest rate you’ll actually pay and add an extra 2.5-3% on top of that interest rate. The combined interest rates are what your stressed mortgage repayments are calculated on.

For example, based on an $800,000 owner occupied loan, on P&I repayments with an LVR of 80%, this scenario could apply

Variable interest rate 1.96%

Assessment buffer 2.5%

Bank Assessment Rate = 4.46% (1.96% + 2.5%)

This means whilst the borrower would only pay the mortgage repayments at the rate of 1.96% (estimated at $678 per week), the bank assesses your mortgage repayments as though they were at 4.46% (estimated at $930 per week).

That means that if your income supports the repayments as though they were $930 per week, the lender will approve the home loan approval. If your income doesn’t support the repayments at that level, then the bank will decline the approval.

This buffer is important when it comes to variable interest rate increases. Being a variable interest rate, the banks know that that the rates will increase at some point in the future, so they factor in a buffer to ensure the borrower can absorb those increases.

But what about when living expenses increase along with interest rates?

The banks have that covered too. When they assess your ability to repay the loan, they take into account your living expenses in line with HEM (Household Expenditure Measure), which is a calculation based on standard living costs for your situation. If your actual living expense are lower than the industry standard HEM, the bank will automatically apply the HEM amount instead of your actual costs to ensure you will still have enough income to cover your repayments.

The HEM rate will differ depending on your situation and how many dependents you have.

Advertised variable interest rates

Cheaper variable interest rates

One of the benefits of working with a mortgage broker like Mint Equity is that we negotiate with the bank on your behalf to get a cheaper interest rate than what is advertised. Most people don’t realise that the advertised interest rate on a bank’s website is higher than what we can source on your behalf.

‘Pricing’ is a term we use in the industry – whereby we request better pricing from the bank than their advertised rate. 9 times out of 10, we secure a discount on their advertised variable interest rate, passing that saving directly to our clients.

Flexible variable interest rates

When it comes to variable interest rates, many borrowers select them because of the flexibility.

Most variable interest rate loan products come with an offset facility, which means if you receive irregular income (like bonuses, overtime or dividends), the money in your linked offset account reduces your loan balance, and therefore the amount of interest you pay on your loan.

For example, if you have a home loan balance of $250,000 and have $10,000 in your 100% offset account, you’ll only pay interest on a home loan balance of $240,000. Because your home loan interest is calculated daily, every dollar in your offset account can save you money in interest. That means more of your repayment goes towards paying down the principal, helping you to repay your home loan faster. Offset facilities aren’t available on a fixed interest rate loan.

Variable interest rate loan products also make it easier and cheaper for the borrower to discharge their loan without penalty. For example, if they sell their property, they can just discharge the loan and pay a small discharge fee. If they were on a fixed interest rate, there would be a break costs to discharge the loan early. This can sometimes be a substantial cost depending on the difference between the original fixed rate and the current rate. The remaining loan term will also impact what costs are charged.

Ongoing interest rate reviews

One of the benefits of being on a variable interest rate is the rate is always up for negotiation. This is why Mint Equity has a dedicated team that review all our client’s interest rates and property values every six months. That means we proactively approach the lender and request a discount on their interest rate. Depending on what is happening in the market, the lender might agree to reduce the variable interest rate by a few points, particularly if there is another lender offering a lower rate. Every day we save our clients money on their home loans by proactively reviewing their options to ensure they have the best interest rates.

If the borrower is on a fixed interest rate, you can’t request a discount. You have to wait until the end of the loan term to change the rate.

Now that we’ve covered off on the reasons why some people choose variable interest rates, we come back to the fact that interest rates have been at their all time lowest level for the last two years.

So, how many interest rate rises would we need to make it more financially viable to choose a fixed interest rate?

Fixed interest rates

The beauty about fixed interest rates is that they are fixed. That’s the long and short of it. You know exactly what your mortgage repayment will be for the fixed term period.

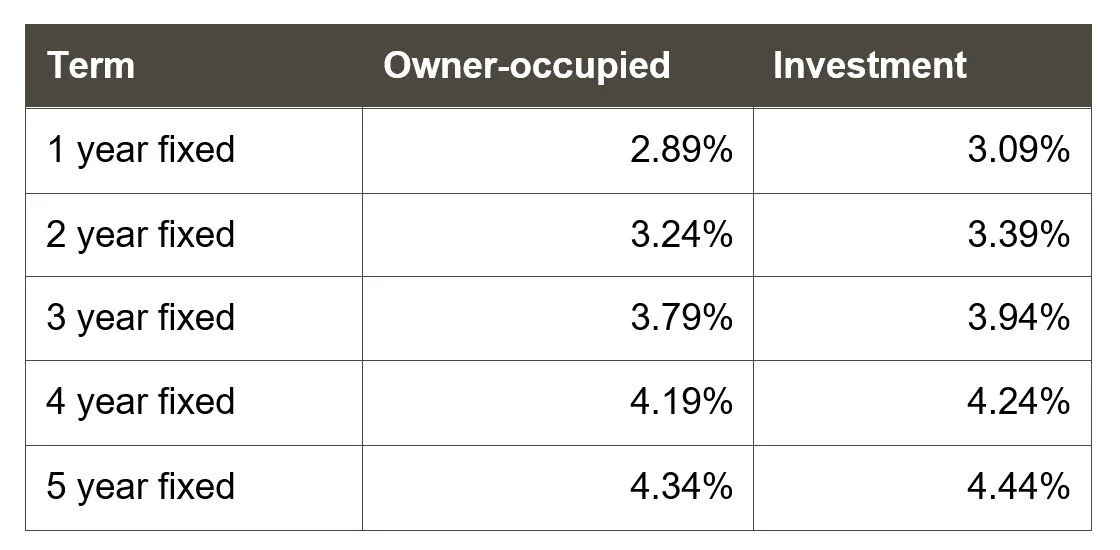

Here are some of the lowest fixed interest rates from the major banks in the market at the moment. Note: There are cheaper fixed interest rates available with second tier lenders.

The issue we are now facing when it comes to the decision process, is that fixed interest rates are now much, much higher than the variable interest rate.

With variable interest rates starting from 1.96%, almost a full 1% lower than a 1 year fixed interest rate, the decision to go with variable or fixed interest rate can be tricky to make.

Westpac cash rate forecast

This week, Westpac have updated their interest rate forecast and they are now expecting the RBA to increase the cash rate by 0.4% (40 basis points) in June.

That would take the current cash rate from 0.1% to 0.5%. Whilst they are forecasting an increase in the cash rate to 2%, that appears to plateau from June 2023 to December 2023.

The RBA has indicated that they would like to increase the cash rate as inflation rises, and walk back the emergency cuts to the interest rate implemented in 2020. Both the Bank of Canada (April 13) and the Reserve Bank of New Zealand (April 13) have opted for 50 basis point increases, which the Australian RBA referenced in their most recent meeting minutes, giving an even stronger indication that a cash rate increase is on the way.

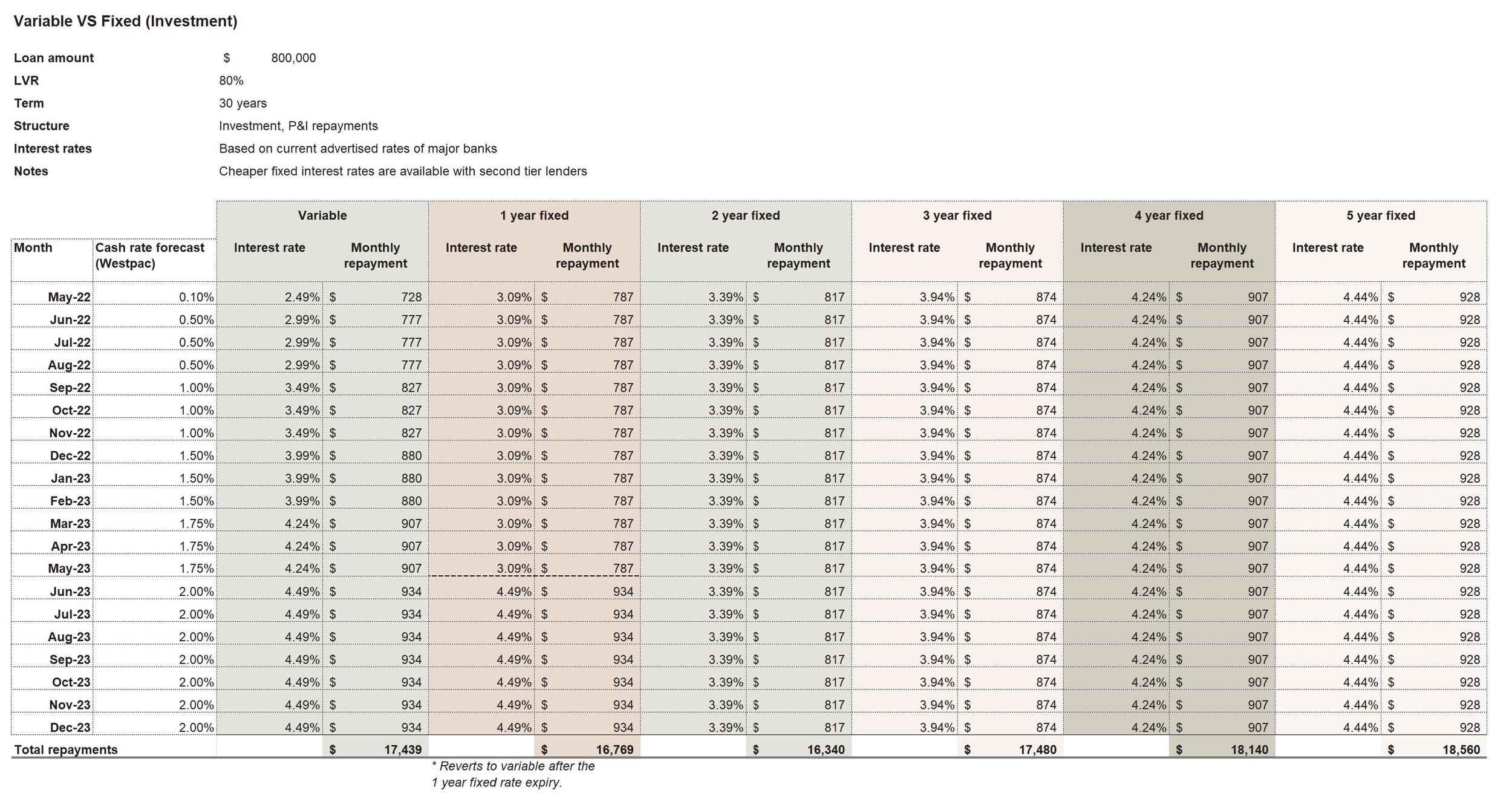

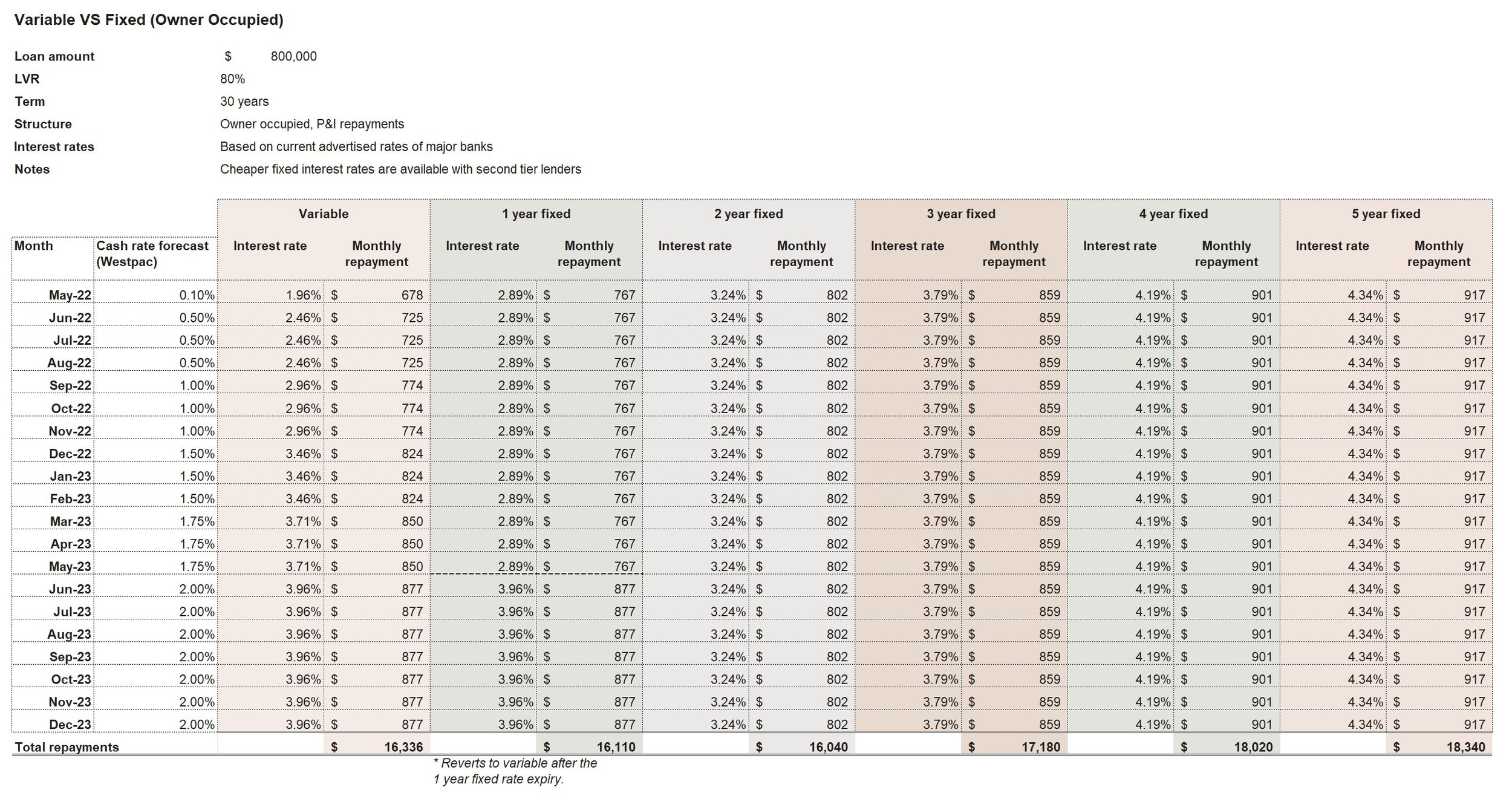

Banks are profit machines, not charities

However, it is important to remember that this is Westpac’s forecast. They are in business to make money on the products they sell. So, it is in their best interest that borrowers are locked into a fixed interest rate which may be higher than the variable rate. With predictions of the cash rate increasing over the next 2-20 months, many borrowers are becoming scared and selecting fixed interest rates. This might be the right choice for some, but if we look at how those increases that Westpac has forecasted applies to the standard variable rate, you can see some fixed interest rate options are more costly for the borrower. You’ll also see how the owner-occupied rates differ to the interest rates for investment properties.

Banks will change their interest rates regardless of the cash rate

And the final piece of the puzzle is, the cash rate is only an indication of what the banks might do to variable interest rates. Banks have already been increasing their variable interest rates without the RBA cash rate moving. For example, St George increased their Basic Variable interest rate by 1.74% on 24 March 2022 and ANZ increased their Standard Variable interest rate for Investment (I/O) by 1.20% on the same day, so interest rates have already been rising without any movement from the RBA.

In turn, when the RBA dropped the cash rate four times in 2020, some banks didn’t pass on the rate reductions in full, which is a reminder that the banks will do what they want, when they want.

How to decide if you should go fixed or variable

There are a few situations where variable or fixed might be more beneficial to your situation. If these statements resonate with you, you might have your answer;

Best of both worlds : Variable and Fixed interest rates

Remember, you can always hedge your bets by splitting your loan into both variable and fixed interest rates. You can keep a portion of your loan on variable so you get all the benefits of having an offset account for that portion, whilst having the security of some repayments based on a fixed interest rate.

Talk to an experienced mortgage broker

When it comes to weighing up your options, you don’t have to go it alone. The team at Mint Equity are here to help you refinance or purchase. Contact us today to chat about your options.