As the weather gets cooler, interest rates are heating up! For those interested in securing a low interest rate on owner occupied properties, this current promotion could be just the thing to help you squirrel away some extra funds.

Low interest rates are the ideal, but their features don’t suit everyone, so let’s take a more detailed look at this product.

Rate feature guide

Variable or fixed interest rate of 3.64% pa

This product offers a choice of either variable or fixed for 2 years at an interest rate of 3.64% pa on owner occupied residential properties (purchases or refinance) who are new customers to the lender.

Owner occupier residential properties

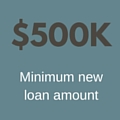

This product is only available to owner occupier residential properties (purchase or refinance) and not available for investment properties. Minimum loan amount is $500,000.

Fees and charges

This product is subject to a $375 annual administration fee. There is no application, valuation or establishment fees. A discharge fee will apply. If more than one valuation is needed, then an additional fee will apply for each additional valuation.

Up to 90% Loan to Valuation Ratio (LVR)

Up to 90% Loan to Valuation Ratio (LVR) is available including Lenders Mortgage Insurance (LMI).

Repayments

This product is only available on a principal and interest repayment. Interest only is not available on this product. 100% offset is also available on the variable component of the loan.

Offer expires soon

This offer is for a limited time only and the lender cannot provide an end date as they have sourced low cost funds. Once all the funds have been allocated, the offer will expire.

What to do next?

Get in touch with Mint Equity and we can discuss if this product is suitable for your situation.

How much does Mint Equity charge?

We don’t charge fees for our services as we are remunerated by the lender you choose once the loan reaches settlement.

How can Mint Equity help?

The real value of Mint Equity is that we help educate clients on the options and lending strategies that help them achieve their goals. Our Director, Zac Peteh has over 20 years banking experience. Zac has experience working in credit and understands how credit thinks, which is incredibly important to securing home loan approval. Zac’s experience is spread across residential, commercial and SMSF lending so you don’t have to deal with multiple brokers or bankers for each different loan. Click here to learn more about Zac’s expertise.

Variable interest rate pros and cons

Pros

- They are usually lower than fixed rates

- There are no break costs to end the mortgage contract if you sell or refinance your home

- You can have an offset account which means you can pay more off your mortgage, but still access that extra cash if you need to

- As you have no break costs, you have greater flexibility to refinance if you want to change lenders

Cons

- Your interest rate is dependent on economic activity and the bank/ lender’s choice to increase interest rates

- If interest rates increase your repayments will increase

- Regular review is needed to ensure you’re always getting the lowest home loan interest rate, however Mint Equity will review this regularly for clients.

WHO SHOULD CONSIDER A VARIABLE INTEREST RATE HOME LOAN?

Variable home loans are great for short term borrowers, those needing flexibility or home owners who have bursts of cash flow.

One of the benefits of having a variable home loan is the ability to throw extra cash into the home loan’s offset account, which will reduce your mortgage repayments. This has the added benefit of being able to draw the money back out of the offset account when you need it.

If you think you might sell your home within a few years of purchasing it, then a variable rate home loan may suit better than a fixed rate home loan as you will not incur a break cost for paying off the home loan early (or during the fixed term).